It is that time of year again when health insurers, who offer and sell Medicare Advantage plans and supplements, ramp up operations and sales activities heading into the annual enrollment period (AEP). It is an incredibly stressful time as they look to grow their Medicare Advantage membership. The outcome of how many net new members gained compared to the forecast will add even more stress to their businesses.

With AEP starting in October each year, which also is the same month as Halloween, it’s somewhat ironic that developing an effective AEP enrollment forecast can involve a little bit of “hocus pocus”. I thought it would be interesting to discuss the mechanics used in creating the magic potion for an effective AEP forecast.

The importance of an accurate forecast.

After forming and finalizing a forecast, health insurers ramp up teams within their call centers and back office operations, build out training programs, make sizeable investments in technologies and services, and more. Obviously, an argument can be made around making a prudent investment in developing an effective forecasting model knowing there is a lot riding on the outcome of AEP. However, this is not always the case. In fact, in most cases plans continue to struggle with “connecting the dots” on why AEP did not meet the forecasted objectives (or within a reasonable variance from the forecast).

What typically goes into making a strong enrollment forecast?

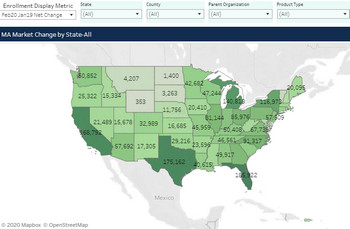

The answer is not as simple as you would think. What can be said is that for those plans that have fully committed to the Medicare Advantage market, and that have served the market the longest, typically also have well thought out forecast strategies. And for those plans that remain committed, there are some common data points that can produce sound forecasts. It certainly makes sense that leveraging experts, using data analytics to assess the market, analyzing the competition and understanding the possible effects from a variety of other elements, can produce a reasonable forecast. These other elements may include broker / agent channel strategies, marketing and promotion investments, hospital and provider networks contracts, drug formularies, plan rates, Star ratings, product design, and more.

To simplify, I would suggest health plans develop a forecast on a plan-by-plan basis and by local area or region. Looking at the historical performance within those markets will tell a valuable story. For example, looking at the previous three-year trend within a market, the data may show that a new product was introduced into the market (e.g., $0 PPO plans) which dramatically outperformed others in the last two AEPs.

Going a bit deeper, the data may also reflect that this same market experienced a high degree of churn. Determining the churn rate can be challenging, but with some simple data analytics you can properly size the market (total addressable market, or TAM) to understand how membership is flowing on an annual basis. Further, churn can be caused by many factors including the continual shift in plan designs / offerings or the changes to network providers and drug formularies. Adding or removing popular hospitals, pharmacies, and prescriptions will typically account for a sizable change to enrollment.

Other critical factors to consider in developing a forecast.

A proper AEP forecast should include a reasonable variance on the possible results. These “factors” should be applied by plan and by local area/region. For smaller insurers who offer one or two plans in one or two markets, this variance may have less of an impact. For larger insurers, this variance across many markets across many plans will certainly add up. Critical to this equation is factoring in your operational capacity in the event you exceed these variances by a larger than anticipated margin. In this case, what contingencies can be put in place to overcome these situations?

I think it goes without saying that health insurers that make the investment in developing a strong methodology and model for forecasting will, no doubt, result in fewer surprises. Like Halloween, some surprises can be fun, but many others can be very scary.