Understanding members and proactively prioritizing fall risk

Twenty-eight percent of American seniors over 65 report falling each year.1 Most don’t tell their doctors.

For these millions of adults, falls are the number one cause of traumatic brain injury and 95% of hip fractures.2 The CDC estimates that older adults’ falls cost our healthcare system $50 billion annually.3 At the same time, Medicare Advantage Star Ratings values and numerical averages for reducing fall risk haven’t improved—they’ve actually declined over the past three years. At an average cost of $35,000 to $51,000 and the potential for life-changing injuries, we have an opportunity to do a better job at preventing falls.

I recently participated in a fall prevention webinar for health plans with several American Specialty Health experts. We covered topics related to falls and improving members’ health outcomes, including the effectiveness of fall prevention programs, interventions, and how health plans can better understand their members who are at risk.

How can you reduce falls for Medicare Advantage members?

Typically, there are several components in a successful fall prevention effort:

- Exercise programs

- Risk screenings

- Home hazard assessements

- Fall prevention tools and products

Once you decide to implement some or all of these components of a fall prevention program, how do you better understand how many and which members would benefit? How do you clinically prioritize members and engage them in these programs?

A proactive, predictive model paired with targeted member engagement can provide fall risk insights and serve as a great complement to traditional fall programs. Our models apply a statistical machine learning algorithm informed by clinical perspectives to categorize members for fall risk based on individualized parameters. We draw on seniors’ health insurance claims data and are guided by published studies. Health plans today have immense demographic and clinical data to identify members at high risk for falls proactively.

Designed to quantify the risk of an ICD-10 fall diagnosis code within 24 months, the Convey model may include up to 20 risk strata. Study results show that customers in the highest risk category have more than ten times the chance of falling than those in the lowest risk stratum.

How can you engage high-fall-risk members?

Convey builds clinical personas and profiles for every health plan member. Once the members are prioritized for engagement based on the risk strata, Convey applies additional models determining the members’ likelihood to engage and preferred method of engagement. The next step is to apply targeted, actionable and timely engagement, resulting in higher reach rates and greater program adoption.

Success relies on the health plan’s commitment to ongoing data monitoring, ensuring timely clinical follow-up, and engagement. This work can be done internally or through an external partner, ideally on a weekly or monthly basis.

Benefit considerations

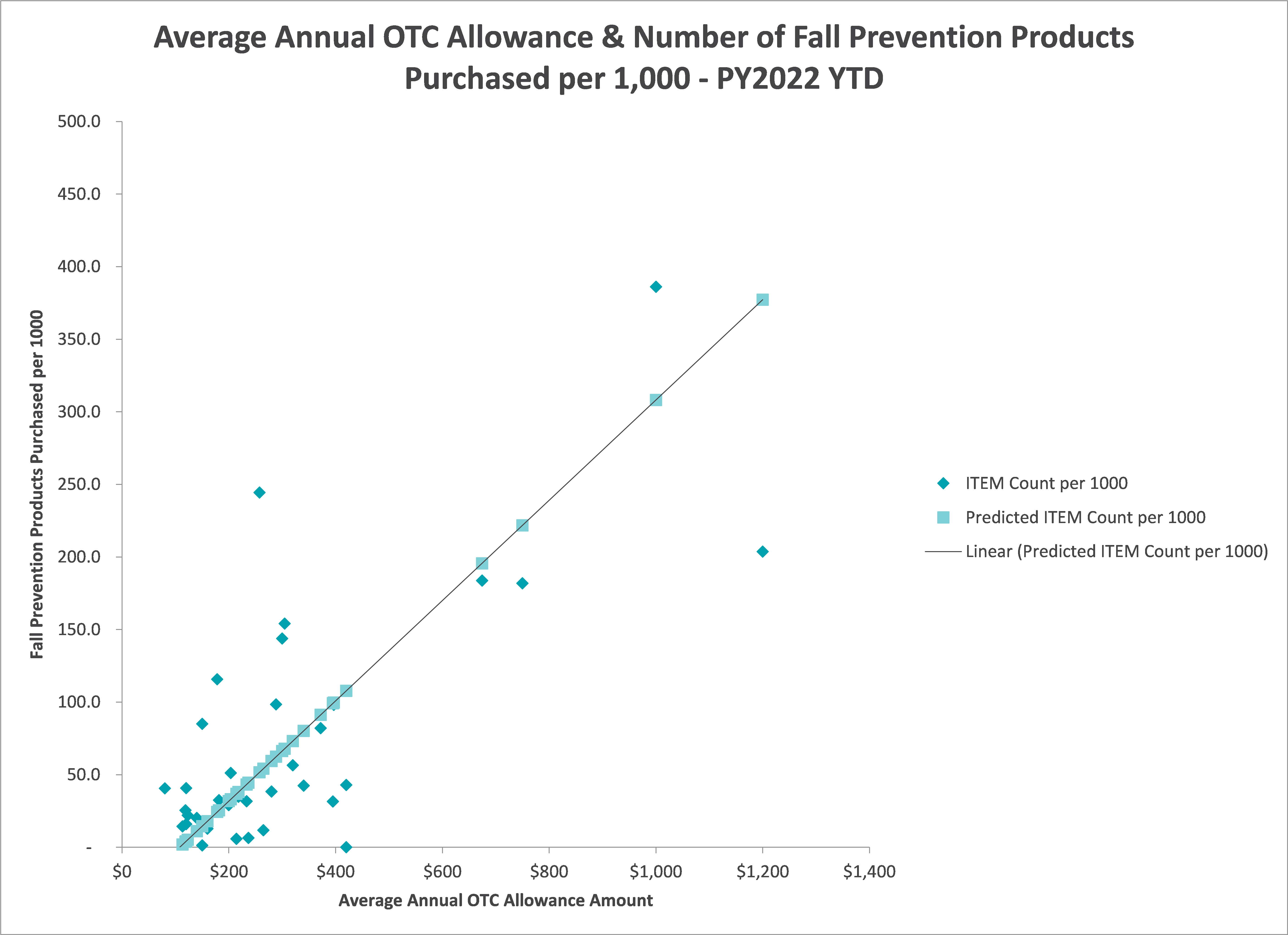

How Medicare Advantage organizations structure their benefits and supplemental benefits programs impact how members manage their care. To further explore this concept, we decided to analyze our clients’ benefit utilization based on the members’ annual benefit amount and the number of fall prevention products purchased per 1,000 members. The analysis showed a positive correlation between the OTC allowance amount provided to members and the types of products purchased. More fall prevention products are purchased when members are given higher allowances (see figure 1 below).

For the 2023 plan year, we are seeing HMO and PPO plans increasing their quarterly allowances to $50-$75 and SNP products including allowances in the $150-$250 range. An analysis of members’ clinical needs informs Medicare Advantage organizations’ supplemental benefits account development and determines the proper allowance.

This graph illustrates the correlation between the type of products members purchase and the amount of the allowance health plans give members.

Supplemental benefits don’t just attract and retain members

A proactive and responsive approach to preventing falls and mitigating adverse outcomes employs a multi-pronged approach to stratification and identification of customers, including claims data models, supplemental benefit utilization, clinical data gathered at the home, and client-provided inputs.

Supplemental benefits are a growing area of investment for Medicare Advantage plans:

- They can attract new members in this highly competitive market.

- They can retain members since empirical data shows that those who use their supplemental benefits are more likely to stay.

- They can improve the health outcomes of members.

While supplemental benefits have traditionally been used as a sales and marketing tool, more and more plans are seeking ways of better optimizing these benefits by strategically structuring their benefits to improve clinical and quality outcomes.

If your organization is looking to implement or build upon your fall prevention program, our team is available to discuss the best approach for your plan.

1 “Older Adults Falls Reported by State,” CDC

2 “Keep On Your Feet—Preventing Older Adult Falls,” CDC

3 Florence CS, Bergen G, Atherly A, Burns ER, Stevens JA, Drake C. Medical Costs of Fatal and Nonfatal

Falls in Older Adults. Journal of the American Geriatrics Society, 2018 March