A 2018 CMS final rule added flexibility to Medicare Advantage (MA) plans in determining supplemental medical and non-medical benefits available to beneficiaries. One such benefit, the Over-The-Counter supplemental benefit, has grown to over 50% market penetration, which outpaces any other newly expanded supplemental benefits.

THE SURGE IN OTC COVERAGE

“We’re going to have an interesting discussion in the next 5 to 10 years because Medicare Advantage has always been a smaller portion of Medicare and Medicare fee-for-service has dominated. Well, that’s changing now.”—Alex Azar, Health and Human Services (HHS) Secretary on December 4th, 2018 at the American Enterprise Institute

Fueled partly by government steps to strengthen the program, Medicare Advantage (MA) has seen unprecedented growth. According to an analysis of enrollment data from the Centers for Medicare and Medicaid Services (CMS), membership has increased by 31% since 2015. Plans continue to capitalize on MA’s popularity, as it accounts for 36% of 2019 Medicare enrollment.

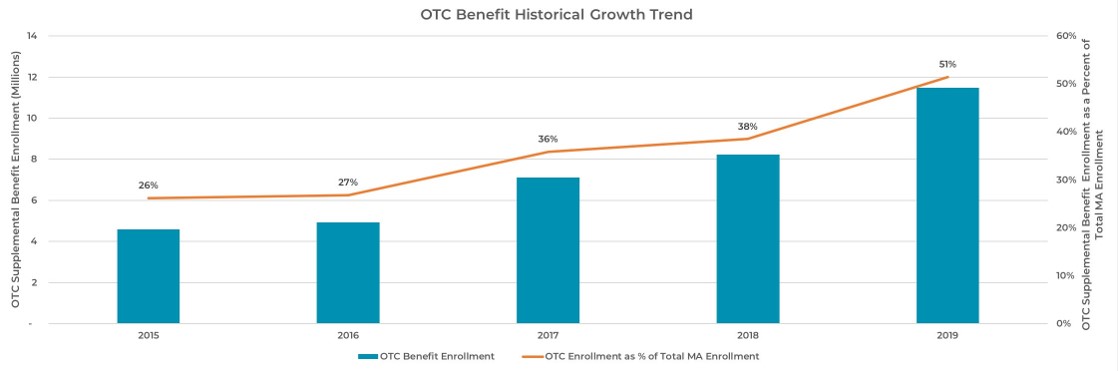

An unheralded element of this growth has been the increased adoption of the over-the-counter (OTC) supplemental benefit contained within MA service offerings. This particular benefit has grown to over 50% market penetration, with a significant uptick in 2019 (see Exhibit 1).

Exhibit 1: OTC Benefit Historical Growth

WHY THE UPTICK IN OTC COVERAGE?

Gains in MA enrollment were driven by recent regulatory changes that have enabled MA plans to augment plan options and benefits.

Supplemental Benefit Augmentation

A 2018 CMS final rule added flexibility to MA plans in determining supplemental medical and non- medical benefits available to beneficiaries. This change allows MA plans to tailor benefits to specific medical problems and patient needs to improve preventative care and reduce health complications or costs. The following list of benefits are growing in popularity and have been deployed to make plans more attractive (particularly to Baby Boomers) and to contain costs:

-

-

- OTC benefit programs

- Meal delivery services

- Transportation options for medical appointments

- Telehealth options to prevent unnecessary movement

- Home improvement installation (e.g., wheelchair ramps, bathroom grab bars)

- In-home support services

- Adult day care services

-

Relaxed guidance on supplemental benefits allows more robust MA plans to be offered in the market, leading to greater product innovation, heightened competition and improved care management across the consumer engagement model.

Increase in MA Plan Payments

CMS’s recent increase in average plan payments from 1.84% in the proposed rule to 2.53% in the 2020 Rate Announcement and Call Letter (released April 1, 2019) may encourage plans to invest in expanding beneficiary access to supplemental services. While regulatory shifts enable expanded benefits, this change in reimbursement from CMS makes offering OTC and other supplemental benefits more attractive.

Senior Shopping Preferences

According to Deft Research’s 2019 Medicare Shopping and Switching study which details Medicare consumer preferences, the availability of supplemental benefits appears to be a highly motivating factor for shopping. Notably, an OTC pharmacy allowance (e.g., $30 monthly allowance for OTC pharmacy products, such as cold or allergy medications, vitamins, or compression socks) ranks as one of the most popular benefits across a total of 17 supplemental benefits studied.

George Dippel, a Senior Vice President of Client Services at Deft Research, provides additional insight into consumer shopping behavior, indicating that nearly all plans have adopted varying levels of OTC benefits. According to their findings, the most alluring benefits are those with “elevated allowance levels [which] constitute ‘saved money’ for seniors.” These are benefits that seniors previously paid for out-of-pocket, but now the plan is shouldering. Dippel compares the value of allowances to net new benefits, citing an example that “Uber rides may be appealing, but they are not as appealing as enhanced allowances that save seniors money.”

OTC Benefit Expansion

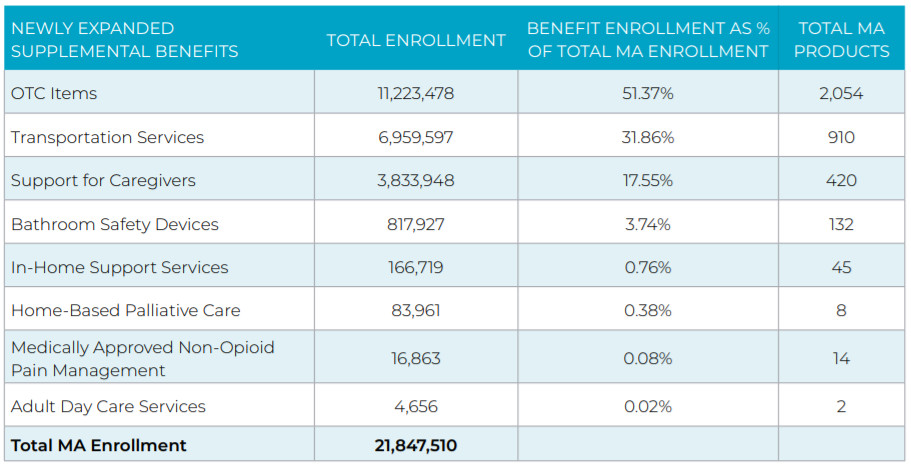

A review of the 2019 Annual Enrollment Period Supplemental Benefits reveals that the growth of OTC programs far outpaces those of other newly expanded supplemental benefits. According to Pareto Intelligence’s proprietary Market Spotlight tool, more than 51% of MA beneficiaries are enrolled in OTC coverage in over 2,000 MA products (see Exhibit 2). This positions OTC coverage as the most attractive benefit across all new supplemental benefits, reinforcing the market research findings from Deft Research discussed above.

Exhibit 2: Benefit Augmentation (For Newly Expanded Supplemental Benefits)

Discrepancy of OTC Benefit Offerings by Carrier

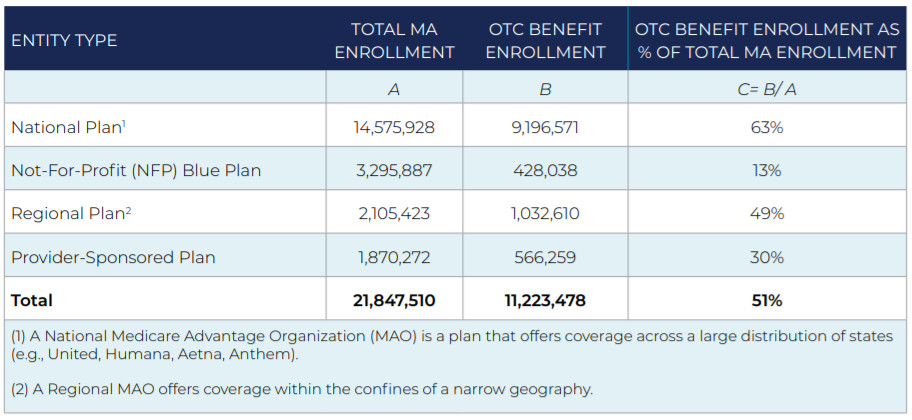

Although more than half of all MA beneficiaries receive OTC benefit coverage, the proportion of members with these benefits varies significantly by plan type (see Exhibit 3). More than 60% of members in a National plan (i.e., plans that offer coverage across a large distribution of states) and nearly 50% of Regional plan (i.e., plans that offer coverage in a narrow geography) members are enrolled in a plan with an OTC benefit. In stark contrast, less than 15% of Not-For-Profit (NFP) Blue plan members and 30% of Provider-Sponsored Plan (PSPs) members have an OTC covered product. The significant delta between National plans’ early adoption of newly expanded OTC benefits signals that they recognize the potential value of offering OTC benefits and have accelerated efforts to proactively capture this value. 2019 enrollment results suggest that Regional, PSPs and NFP Blue plans lag behind.

Exhibit 3: Prevalence of OTC Benefit Coverage

The discrepancy between the National plan OTC benefits versus their competitors’ products is important for two reasons:

-

-

- There is a positive correlation between offering the OTC benefit and resulting membership. A Pareto analysis of 2018 and 2019 MA enrollment found that products that did not offer OTC in 2018 but did in 2019 had the largest growth at 6.5%, whereas products that did not offer OTC in neither 2018 nor 2019 experienced a 0.02% decline in enrollment.

- Investing in OTC benefits may generate healthcare savings. While it may appear that adding an OTC benefit increases administrative complexity for plans, early studies cite that investment in OTC coverage may help manage overall healthcare costs. OTC medicines provide 24/7 access to affordable healthcare options, and each dollar spent on them may save as much as $7.20 for the US healthcare system, according to a March 2019 study determining the value of OTC medicines across nine major categories. (See page 4 of this study for a breakdown of findings.) This study was commissioned by the Consumer Healthcare Products Association (CHPA), a member-based trade association that advocates for the consumer healthcare products industry. Savings are generated from lower drugs costs and fewer emergency department and healthcare provider visits.

-

A recent study in Health Affairs, which analyzed the impact of value-based insurance design (VBID) through a review of 21 publications, found that VBID may not unlock its full cost savings potential absent an OTC benefit. Researchers cite minimal savings because of increased drug spending despite higher medication adherence and reduced spending in other areas. On the flip side, plans offering an OTC benefit may see value materialize with improvements in Star, HEDIS and Net Promoter Score (NPS) ratings, along with higher member retention and increased satisfaction.

TYPES OF DELIVERY MODELS

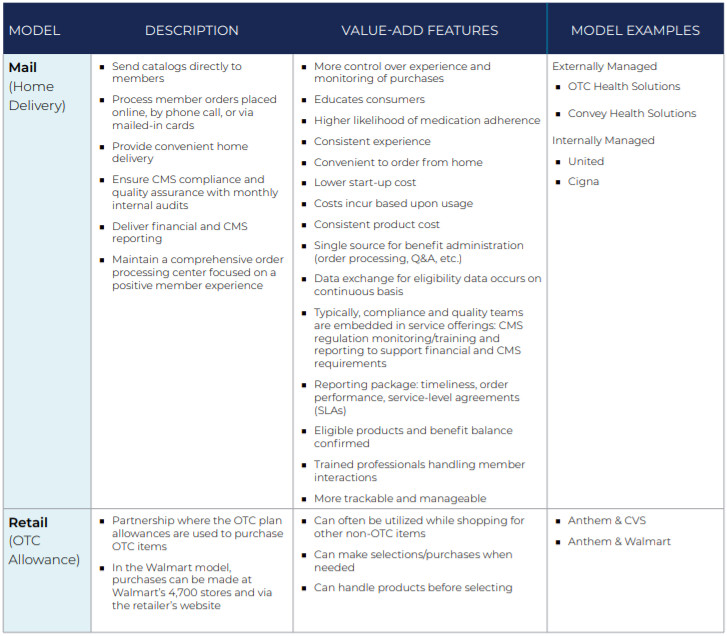

Mail and retail are the two most prominent OTC models in the market. Both models not only provide convenience to an older population which values a seamless shopping experience, but also reduce member out-of-pocket cost burden for a population that may be on fixed or limited incomes. Exhibit 4 compares both models, highlighting the differentiators of both and value to consumers.

Exhibit 4: Mail vs. Retail OTC Delivery Models

While the two models offer significant value, members must be wary of potential downside considerations:

-

-

- Mail: It may take a few days to receive ordered products in the mail. If there is an immediate need, members should visit a local store.

- Retail: Various vendors offer prepaid cards for OTC products, but not every OTC product is eligible for coverage under CMS rules. Members could use a card to attempt to purchase a product that is not covered.

-

MA PLAN STRATEGIES

Given the surge in demand for OTC benefits and the intensity of competition within the MA marketplace, plans should consider the following offensive and defensive strategies to continue to attract membership, as more and more Boomers continue to age into Medicare coverage:

1. Consider OTC as a differentiator in coverage of and access to self-care products (e.g., how it is delivered).

2. Consider OTC as a method to support core care management strategies allowed for specific conditions.

3. Research potential cost savings (emergency department visits, hospital admissions) to support bid augmentation.

4. Leverage a member-centric benefit that avoids grievances. With supplemental benefits particularly, plans should seek to minimize grievances received as a result of coverage.

5. Ensure a highly compliant solution when exploring vendors

CONCLUSION

As plans expand health-related supplemental benefits, access to OTC coverage should be a central consideration, as recent market experience and data analysis begins to suggest that offering OTC benefits leads to enrollment growth and potential healthcare savings. With the convergence of regulatory guidance and increased CMS reimbursement, HealthScape expects plans to continue to expand health-related supplemental benefits. Given that plans had a short timeframe to react to changes in regulation during the 2019 bid cycle, the introduction of innovative models to cover OTC products for cost and utilization management purposes in 2020 will become a more standard practice, particularly as plans measure the impact this convergence has on the affordability and quality of care for MA beneficiaries in the future.

The prevalence of offering OTC benefits is on the rise, and health plans need to be armed with the appropriate strategies to capture the opportunity. HealthScape can help.