Supplemental benefits have been a valuable differentiator for Medicare Advantage plans since the Centers for Medicare and Medicaid Services (CMS) expanded the scope of coverage to certain non-medical supplemental benefits in 2018. Since then, there has been a continued expansion in the adoption of supplemental benefits, which has required Medicare Advantage Organizations (MAOs) to become even more creative in their plan designs to remain competitive.

As MAOs establish product design strategies for 2022 and beyond, understanding the 2021 AEP trends and anticipating competitive activity is critical to capturing, maintaining, and growing market position.

To help MAOs, Convey leveraged the Pareto Spotlight solution to evaluate the February 2021 CMS Medicare Advantage plan benefit data to gain insight into national and regional market trends. This included product trends, trends by type of MAO, and supplemental benefits being offered. Examination from Pareto’s data scientists illustrate not only the prevalence of over-the-counter (OTC) programs, but also how OTC benefit design correlates to plan enrollment.

Introduction:

As a leading healthcare technology and services company, Convey Health Solutions (Convey) consistently provides health plans with improved market strategies for designing effective OTC benefit offerings that also enhance member experience and satisfaction. To do this, Convey leverages expertise and insights from its family of companies, Pareto Intelligence (Pareto), HealthScape Advisors, and GHG Advisors.

The knowledge gained from this analysis helps to drive strategic decisions for the Convey clients, including formulating product pricing and benefit design for their CMS bids. Although benefit design strategies vary, the data suggests strongly that the inclusion of a well-designed, member-centric OTC benefit improves overall membership growth. Examination from Pareto’s data scientists illustrate not only the prevalence of OTC programs but also how OTC benefit design correlates to plan enrollment.

Aims & Objectives:

Examine the over-the-counter (OTC) supplemental benefit in detail, uncovering reportable patterns, trends, and key findings amongst Medicare Advantage plans.

Focus of Research:

-

-

- Growth of the OTC supplemental benefit

- Growth of OTC benefit allowances

- Impact of OTC benefit allowances on enrollment

- The most popular OTC benefit structure

-

Methodology:

Pareto analyzed Medicare Advantage plan benefits data released by CMS in the fourth quarter of 2020 (Q4 2020) and first quarter of 2021 (Q1 2021). Pareto excluded Medicare Prescription Drug Plans, Employer / Union-Only Direct Contract PDPs, PACE and Demo plans from the CMS PBP files for this analysis. The analysis includes Medicare Advantage plans in the 50 states, DC, and the territories.

Timing & Outputs:

Pareto released a thorough analysis of supplemental benefits in March 2020. April observations by GHG Advisors into the growth and prevalence of supplemental benefits in 2020 presented the following results and trends.

-

-

- Trend #1: Supplemental benefits are becoming table stakes in nearly all markets

- Trend #2: National plans are offering supplemental benefits at a higher rate than other plan types

- Trend #3: Supplemental benefits may impact the plan’s member experience

- Trend #4: The availability of supplemental benefits correlates to higher enrollment growth rates

-

HealthScape Advisors documented the surge in OTC benefit coverage in their 2019 Executive Briefing, and Convey and Pareto conducted an initial OTC benefit analysis in 2019 and a follow-up in April of 2020. This updated market analysis from Convey looks at Medicare Advantage data from December 2020-February 2021 uncovering these following market insights from the most recent Annual Enrollment Period (AEP):

-

-

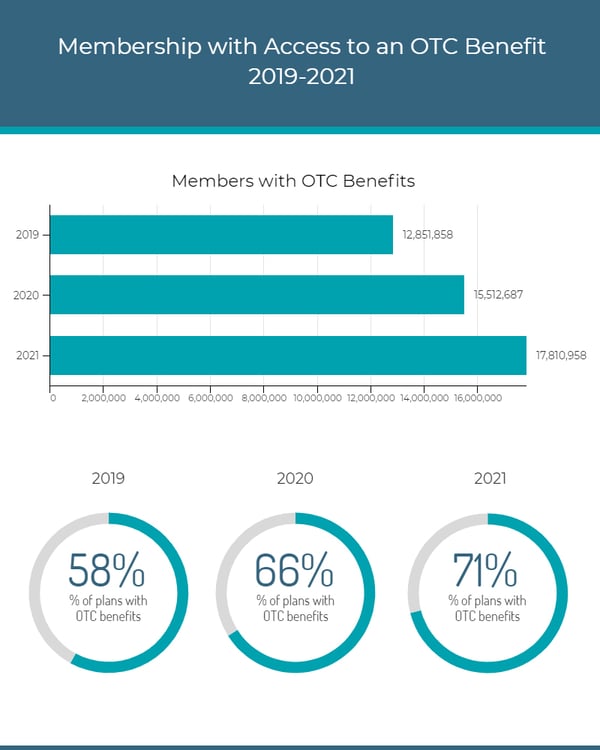

- 71% of plans have an OTC benefit available to their membership, accounting for almost 18 million MA members

-

-

-

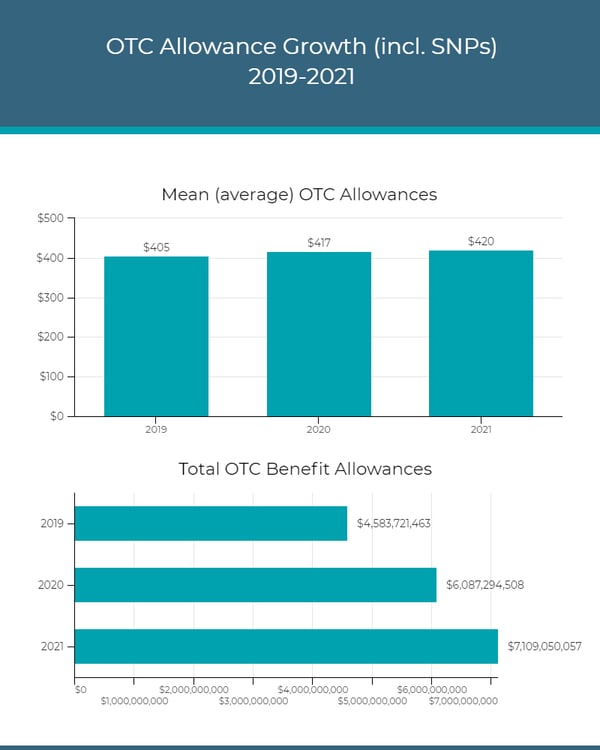

- Total OTC allowance in the MA market grew to $7.1B, and allowances overall increased for 2021.

-

| Excluding Special Needs Plans (SNPs) | Including Special Needs Plans (SNPs) | |

| 2021 Mean (average) OTC Allowances | $289 | $420 |

-

-

- Plans offering OTC experienced overall enrollment growth of 15%

- Comparatively, plans that did not offer OTC grew 4% overall

- Plans with an OTC benefit allowance greater than $150 experienced overall enrollment growth of 16%

- Comparatively, plans with an OTC benefit allowance of $150 or less grew 9% overall

-

Regarding the administration of health plans’ supplemental OTC benefit:

-

-

- Convey’s OTC benefit customers experienced overall enrollment growth of 18%

- Non-Convey customers (with and without an OTC benefit) grew 5% overall

-

Implications:

The data from 2021 AEP reflects that by providing a more member-centric solution–including dedicated contact center services trained to assist Medicare beneficiaries with understanding their OTC benefit, continuous member communications related to the OTC program, and detailed analytics and reporting to monitor program performance–membership growth increases. With 71% of Medicare Advantage plans providing their members with an over-the-counter benefit, OTC has joined the ranks of other supplemental benefit “table stakes” such as vision, dental, fitness, and hearing.

With the variety of supplemental benefits growing, and their adoption increasing year over year, it is imperative for MAOs to understand the implications in providing competitive benefit designs along with member-centric solutions. Using updated, ongoing analysis, Convey can more effectively serve its clients in this way. Convey clients benefit from improved market strategies and the data necessary to design an effective OTC benefit, or other supplemental benefit, as needed. In turn, Convey’s clients achieve better growth and competitive position in the MA marketplace through a purpose-built OTC program.