Group Medicare Advantage, or Employer Group Waiver Plans (EGWP), is often an untapped market within a comprehensive Medicare Advantage (MA) and senior market strategy for many health plans. Group retiree health insurance markets are experiencing considerable change due predominately to the rapid growth and popularity of Medicare Advantage.

Healthcare industry trends show that membership in MA Individual Coverage has grown 6.1% per year for five years from 2016 to 2020, while MA Group Retiree Coverage grew 8.1% during the same period.

Understanding the EGWP trends may help to better identify ways to adjust your existing group retiree market strategy in order to improve performance in not only the Medicare market, but possibly your large and mid-group commercial markets.

EGWP Trend #1: Growth

Healthcare industry trends reveal an uptick in EGWP growth. Factors leading to growth include:

-

-

- Overall MA Growth: Medicare Advantage enrollment is increasing as the baby boomer generation ages rapidly into Medicare.

- Search for New Solutions: Employers are actively seeking new retiree solutions to manage healthcare costs.

- Coverage Desires: Coverage desires often match or exceed previous employer coverage for retirees while offering flexibilities to health plans.

- Cost Savings: Cost savings are realized through managed care aligning to the trend of value-based healthcare. The most significant cost savings is due to the ability of health plans to contract for services on a negotiated basis rather than just strictly Medicare payment, thus managing the savings and the cost of care. These plans are also subject to changes in the risk adjustment profile of the membership, including the EGWP options. In addition, they receive the same star bonus payment as the HMO / PPO plan portfolios.

-

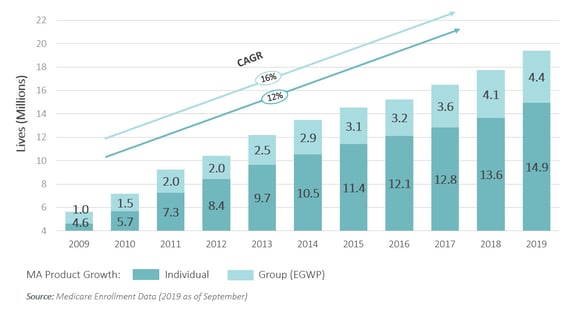

According to Medicare enrollment data as of September 2019, EGWP growth has largely outpaced that of individual MA plans over the past 10 years (see Figure 1).

Figure 1:

In reviewing the distribution of EGWP products in our “How to Successfully Operate a Group Retiree Plan for MA” webinar, we discuss 2019 data illustrating that PPOs are much more dominant at a 76% prevalence, while HMOs (some are point of service plans) are 24%. There is more flexibility in PPO plan design because of the distribution of retirees and the desire to improve benefits for these select populations.

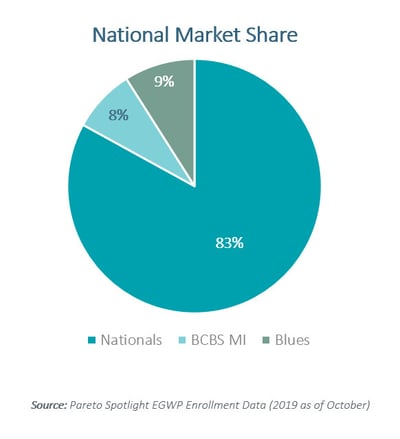

The national carriers, including Express Scripts, Cigna, UnitedHealthcare, Humana, Aetna, and Kaiser Permanente, have capitalized on this market (see Figure 2). They have grown significantly, accounting for 83% of the total EGWP market. Blue Cross Blue Shield of Michigan is at eight percent because of the automotive industry, while other Blue Cross Blue Shield plans make up the additional nine percent.

Figure 2:

EGWP Trend #2: Positioning

Economic and unusual events, like the COVID-19 pandemic, change the relationship between group members and group retirees.

A recent Kaiser Family Foundation analysis of employment data from the Bureau of Labor Statistics shows that the unemployment rate among people age 65 and older quadrupled between March and April 2020; an increase from 3.7% to 15.6%. Those actively working at or over the age of 65 were part of the second-largest population affected by pandemic, surpassed only by the 18 to 24-year-old age group.

Often, when people retire, their health plans are not well positioned to retain these employees coming out of employment or into retiree status. Typically, these retirees enter the open market resulting in opportunity losses to Medicare plans being offered.

The pandemic exposes advantages of a group retiree health plan or EGWP for an employer. Benefits include better healthcare coverage for members, management of costs and balance sheet liability, and cost savings realized through managed care. This EGWP trend reveals that plans are in a prime position to take advantage of otherwise catastrophic events.

EGWP Trend #3: Continued Commitment to Retirees

In the private sector, retiree benefits have remained relatively steady since 2010. For public employers and state governments, the percentage offering retiree benefits is much higher.1

Health plans are looking to provide MA to these types of programs due to the positive impacts previously identified from the flexibility and financial advantages. This is the case for public entities under-funded for EGWP.

Most employers are looking to maintain coverage for current and future retirees,

while some look to limit coverage for future retirees.

Nevertheless, the 65+ group retiree market remains sizeable.

For employers looking to maintain coverage for current employees, research shows that most sponsors (93%) expect to continue sponsorship for Medicare-eligible retirees in the near future.2 Research also shows that the number of large companies and public employers offering health benefits has not changed with much significance over the last five years.

When it comes to limiting coverage for future retirees, some sponsors are increasing eligibility requirements (minimum age / service requirements), etc.

While some plans are phasing out coverage, a significant number of sponsors will continue to offer coverage to future retirees.2 Despite some contraction in the number of employers providing health benefits to retirees, the 65+ group retiree market remains sizeable now and into the future.

Beyond the EGWP Trends: Considerations Moving Forward

It’s critical to stay abreast of healthcare industry and EGWP trends. Over the past 10 years, EGWP has continued to grow, making this a valuable part of any strategy.

Additional research, planning, and successful execution of key strategic and operational areas will pay off in the end if managed correctly.

Keep in mind that managing an employer group waiver plan is complicated, with many intricate group-specific requirements that can create risk and add layers of manual processes and workarounds for health plans. This can lead to disconnected processes and poor responsiveness, which is not a suitable position for any party involved.

As a leader in purpose-built technology solutions, Convey is well versed in the EGWP Medicare market and the complex requirements to operate these types of retiree benefits. Our EGWP solutions and services can manage groups of any size or scale to ensure your organization achieves its goals in a more effective manner.

If you are ready to learn more about the market, and how to operate EGWP successfully, watch our on-demand webinar or connect with an EGWP expert and

1. Agency For Healthcare Research and Quality (AHRQ) Research

2. 2015 Willis Towers Watson Best Practices in Health Care Employer Survey Report